Carbon border taxes add pressure to Australian climate policy

In July 2021, the European Commission proposed plans for the world’s first carbon border tax, putting a price on carbon-intensive imports. At the same time, the US Democratic party also declared support for a border adjustment tax as a means of advancing US climate goals. With businesses exporting to the EU expected to face reporting obligations from 2023 and costs beginning in 2026, it is now clearly in Australia’s economic interest to respond in kind.

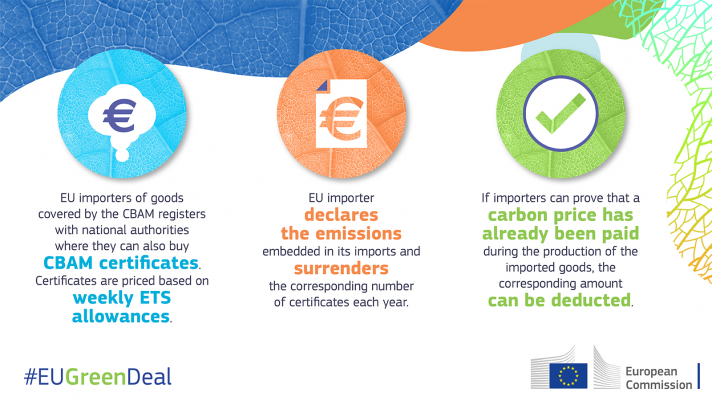

In March 2022, the Council of the EU announced their (general approach) agreement on the Carbon Border Adjustment Mechanism (CBAM) regulation (Council of the EU, 2022). The EU’s long-proposed carbon border adjustment will impose costs on industries and businesses importing cement, aluminium, fertilisers, electric energy production, iron and steel from countries where current climate change policies are less ambitious than those in Europe. That is, companies abroad wishing to sell these commodities to EU customers will need to pay a price on each tonne of CO2 emitted during their production.

This cross-border mechanism is the first of its kind and will symbolise the start of the “Climate Club”: a term coined by Nobel prize-winning economist William Nordhaus to describe a regime in which participating members can impose small trade penalties on non-participants to induce a large stable coalition with high levels of abatement (Nordhaus, 2015). By targeting imports of these carbon-intensive products, the CBAM will ensure that emission cuts within the EU are not simultaneously undermined by imported goods from those countries with little or no climate policy in place.

The adjustment mechanism will also work to mitigate so-called “carbon leakage”, where heavy-emitting companies relocate their production to countries with less stringent climate policy. By imposing a tariff on imports from countries with lax pollution controls, the CBAM protects local businesses—who are investing in emission cutting technologies—from a competitive disadvantage.

Given that full implementation of the scheme is not expected until early 2026, the next few years offer a critical window for Europe’s trading partners to implement climate policies that protect their industries’ competitiveness. One easy way would be to introduce a carbon price that matches or exceeds the EU price. Australia could also introduce its own CBAM, long recommended by CCL as an essential component of its climate dividend.

Recent economic modelling suggests that—without any serious changes to domestic climate policy—the imposition of the CBAM could have a significant effect on Australian exporters. Modelling by Victoria University[1] suggests that—given a carbon price of €60 (approximately 100 AUD)—shipments from Australia to the EU are expected to fall by 1.2 percent, representing a loss in value of $5.2 billion based on 2020 total goods and serve exports (Cranston, 2021). The industries hardest hit would likely be coal, iron ore, meat and dairy, with a tripling in coal prices expected to lead to a 2.5 percent reduction in coal exports. While the initial reduction in export demand is likely to be partially softened by a devaluation in the Australian dollar (resulting in increased export attractiveness), a new trade deterioration of 0.34 percent is still anticipated.

With Australia’s trading partners now gearing up to decarbonise their own economies, it is vital that Australia follows suit to remain competitive in world trade. In addition to being in our best interests morally, ethically and environmentally, an effective carbon price is now in our best interest fiscally. It’s in our interests to join a friendly race towards zero emissions.

It’s time to join the Climate Club.

References

Council of the EU. (2022). Council agrees on the Carbon Border Adjustment Mechanism (CBAM) https://www.consilium.europa.eu/en/press/press-releases/2022/03/15/carbonborder-adjustment-mechanism-cbam-council-agrees-its-negotiating-mandate/

Cranston, M. (2021). EU carbon tariff to hit Australian exports. https://www.afr.com/policy/economy/eu-carbon-tariff-to-hit-australian-exports-20210408- p57hfb

Nordhaus, W. (2015). Climate Clubs: Overcoming Free-Riding in International Climate Policy. American Economic Review, 105(4), 1339-1370. https://doi.org/10.1257/aer.15000001

[1] Philip Adams, Research Professor, Centre of Policy Studies, Victoria University